Scentre Group has released its results for the six months to 30 June 2023 with Funds From Operations (FFO) of $556.6 million, up 1.5% and Distributions of $427.7 million, up 10.0%.

Statutory Profit for the period, including an unrealised property valuation decrease of $392.5 million, was $149.4 million. Property values were 0.6% lower compared to 31 December 2022.

Scentre Group CEO Elliott Rusanow said: “Our strategic focus on providing our customers with more reasons to visit our 42 Westfield destinations has delivered strong operating performance and continued growth in earnings and distributions for our securityholders.

“Net Operating Income increased by 10.0% to $971.9 million. This is the highest level of Net Operating Income the Group has ever achieved in a first half period.

“FFO grew by 13.3% compared to the second half of 2022 reflecting strong operational performance and proactive management of our funding costs.

“So far this year, we have increased customer visitations to 314 million, 9.8% more than the same period in 2022. This has been driven by our unique customer activation program, including our partnerships with Disney and Netball Australia, to create extraordinary experiences for our customers at our Westfield destinations.

Scentre Group CEO Elliott Rusanow with Netball Australia CEO Kelly Ryan

“This week we announced a new partnership with Live Nation which will bring exclusive, live and free music performances into our destinations, creating even more reasons for people to visit and spend their time with us.

“Our strategy has enabled our business partners to achieve annual sales of $27.8 billion to 30 June 2023, an increase of $4.9 billion or 21.6% compared to the same period in 2022. This represents another record level of sales across our portfolio.

“During the half, business partners achieved sales of $13.1 billion, an increase of 9.1%. When compared to the same period in 2019, business partner sales are 13.6% higher.

“Demand for space in our Westfield destinations continues to be strong with occupancy increasing to 99.0% compared to 98.8% at 30 June 2022. During the half the Group completed 1,567 leasing deals and welcomed 585 new merchants including 125 new brands to the portfolio.”

Westfield Bondi Junction, NSW

On average, specialty rent escalations increased by 8.1% and new lease spreads improved to +2.6%. Average specialty occupancy costs are now 16% of specialty sales compared to 18% in 2019.

The Group collected $1,332 million of gross rent during the first half, an increase of $82 million compared to the same period in 2022 and equivalent to 103% of gross billings.

Progress continues to be made on the Group’s strategic customer initiatives including the Westfield membership program which now exceeds 3.5 million members, an increase of 750,000 on the prior period.

In June 2023, Scentre Group successfully opened Stage 2 of the $355 million (SCG share: $178 million) investment in Westfield Knox, with visitation in the month following opening 13% higher than 2019. The remaining stages are due to open by the end of 2023.

In July 2023, the Group agreed to exit the Central Barangaroo consortium.

Works continue to progress for the development of 101 Castlereagh Street in Sydney’s CBD.

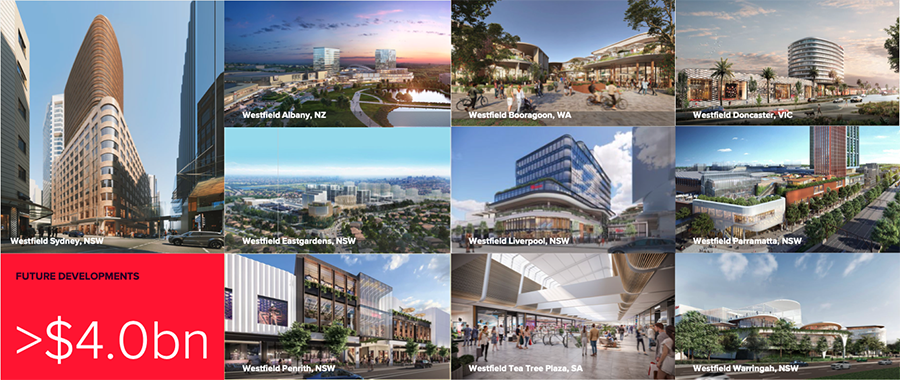

Pre-development work in the pipeline of future opportunities continues including Westfield Booragoon in Perth.

During the half the Group released its 2022 Responsible Business Report, Modern Slavery Statement and its first Climate Statement.

“Progress continues on our pathway to net zero by 2030 with the recent completion of rooftop solar installations at Westfield Fountain Gate and Westfield Knox. Rooftop solar installations at Westfield Hornsby and Westfield Tuggerah will be completed by the end of the year. Together these installations will more than double the Group’s solar generation capacity from 5.9MW to 12.2MW.

“We will continue our focus on creating destinations where people want to spend their time, enabling more businesses and brands to connect with more customers. The Group is well-positioned to continue to deliver long-term growth in both earnings and distributions,” said Rusanow.