How often have we read fairly recently of the demise of CBD retail? More often than not, it is down to sensationalism – that sells newspapers – and many journalists these days look for sensationalism rather than truth. There are some startling figures in this article by Hamish Coleman of Urbis and Melissa Neumaier of CommBank iQ; it’s authoritative, expert and, in SCN’s view, required reading for shopping centre executives.

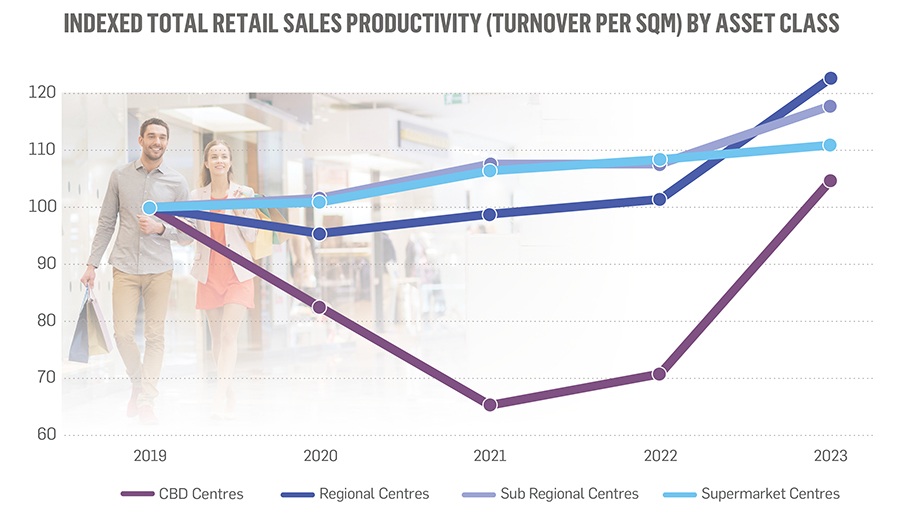

At the height of the COVID pandemic, few issues (except perhaps the disease itself) filled more column inches than discussion around the future of our CBDs. Suffice to say, these weren’t generally good news stories – the pandemic sounded the ‘death knell’ for CBDs, in particular, for CBD retail. And certainly, it got very challenging. In 2021, turnover productivity at CBD centres fell to less than 70% of 2019 levels. This barely improved in 2022, but then in 2023, things started looking up.

Turnover per square metre (m2) at CBD centres rocketed back in 2023 to be 4% higher than in 2019. Between 2022 and 2023, productivity jumped by 48%!

While this represents a decline in real terms compared to 2019 (and remains below other centre-types), there is no doubt CBD centres are on their way back. Much of the doom-and-gloom around CBDs focused on workers and the decline in CBD traffic driven by working from home. Nowhere was this pessimism more pronounced than in Melbourne, which suffered more than any other city under the weight of lockdowns. However, the negativity around the future of CBDs ignored the reality that CBDs ceased to be all about work – and workers – a long time ago. The Melbourne CBD, in particular.

The Melbourne CBD was evolving well before COVID

Like many supposedly COVID-induced trends, the face of the CBD had, in truth, been changing for some time. Decades, in fact. It’s just that most people hadn’t really been paying attention. According to City of Melbourne CLUE data, between 2011 and 2019, CBD office worker numbers only grew by 6%. During the same period, residential dwelling numbers surged by 120%, while food and beverage businesses increased by 21% (and 73% from 2002).

Key retail developments, like Emporium and the expansion of Melbourne Central likewise added to the destinational draw of the CBD. Work was only one of many factors driving CBD visitation.

Even pre-COVID, the impact of workers on CBD shopping was over-stated

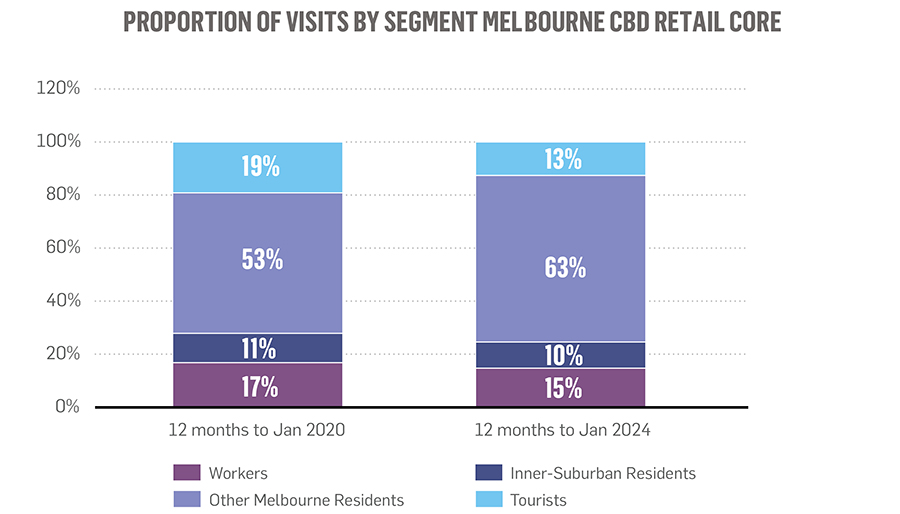

While the CBD still conjures images of commuters in their corporate-wear (largely sans ties these days), the vast majority of CBD-visitors are not there for work at all. And they weren’t pre-COVID either. Analysis of visitation to the CBD retail core, using Human Movement Data (HMD) from the 12 months to January 2020, indicates workers made up only 17% of visits.

The fact is, with some notable exceptions, workers have never been as important to CBD retail as was generally believed. Indeed, visits from combined Melbourne residents who don’t work in the CBD, dwarfed the worker-contribution. This group accounted for 64% of total retail core visits in 2019. Melbourne residents seeking entertainment, retail, cultural and sporting experiences, had already become the engine room of CBD visitation.

‘Experience-seekers’ from greater Melbourne are driving the CBD rebound

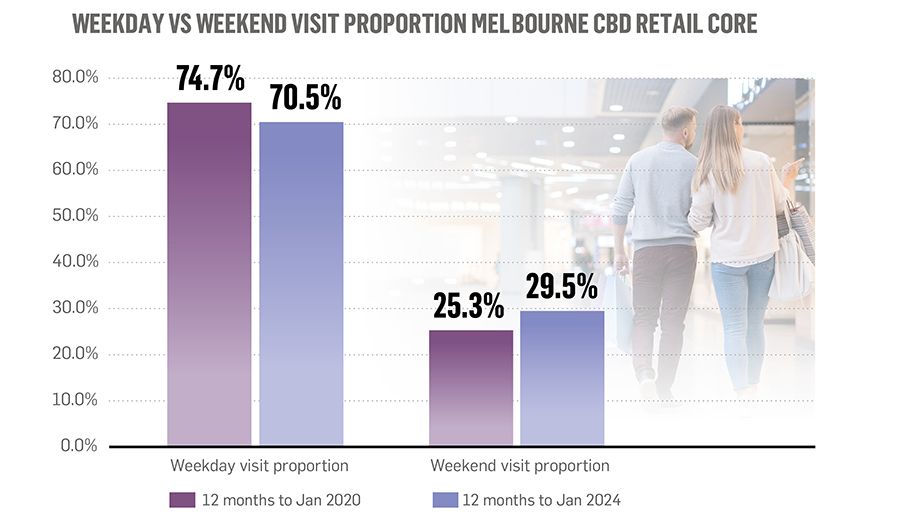

COVID accelerated this trend. By 2023, experience-seeking Melbourne residents had grown their share of total visits to 73%. The worker contribution fell, but only to 15%. This uneven return to the CBD among different visitor segments has impacted patterns of visitation. Traffic for the CBD retail core remains down on 2019, but only by 8%, according to City of Melbourne footfall counters. Traffic in more peripheral areas, dominated by offices, remains 20% lower than pre-COVID levels. Weekend traffic is also becoming more important. HMD analysis indicates weekend visitation now accounts for 30% of total weekly traffic, compared to 25% in 2019.

The way Melbourne residents engage with the CBD is different, depending on where they live. Not surprisingly, people who live in inner-suburban postcodes engage more with CBD retail than those who live further away. Indeed, they engage about twice as much, making up about 14% of visits (among non-CBD workers who live in Melbourne) from 6% of the total Melbourne population. This makes sense. For most of these shoppers, the CBD is effectively their local large-scale shopping centre. Also unsurprisingly, their share of CBD visitation hasn’t changed much pre and post-COVID (11% of visitation in 2019 compared to 10% in 2023) as they were already heavily engaged with CBD retail.

Instead, the group which has under-written the CBD rebound more than any other are the true experience-seekers – those residents who don’t work in the city or live particularly near it. This segment now represents 63% of visitation to the CBD retail core, up from 53% in 2019.

Retailers and landlords are responding to these trends, with the CBD becoming home to more ‘flagship’ stores, Rebel Sport’s experience-led location at Emporium and MECCA’s planned 3,000m2 site on Bourke Street being recent examples. The CBD is continuing its evolution as the epicentre of destinational experiences in Melbourne.

CBD worker spend is actually relatively robust

CommBank iQ data, which leverages Australia’s largest aggregated and de-identified transactional banking dataset to provide rich insights into consumers’ real spending behaviour, provides a fascinating snapshot of Melbourne CBD worker spending patterns both before and after COVID.

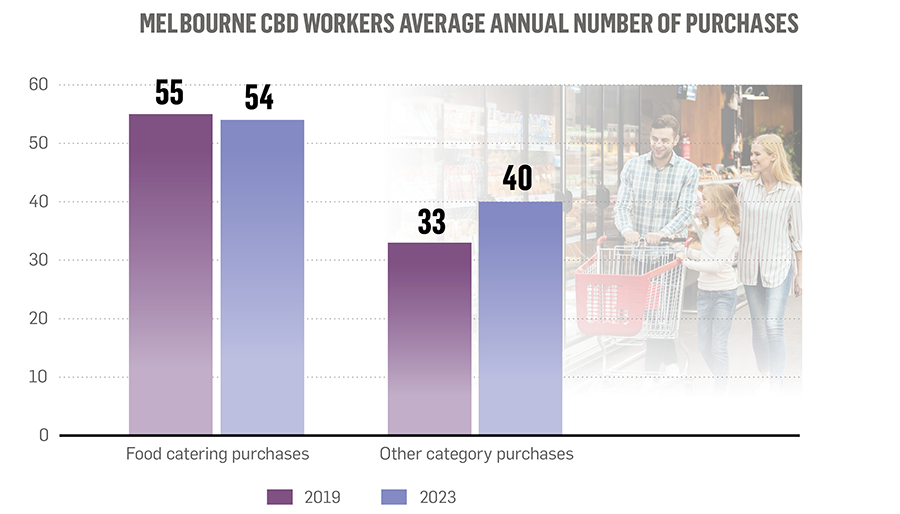

Indeed, it probably busts the myth of a cataclysmic fall in CBD worker spend. While it is clear CBD workers are coming to the office less, those who are coming in are actually spending more. Seven per cent more, in fact. This suggests that CBD workers are ‘compressing’ their shopping visits – coming in less, but making more purchases when they do visit the office.

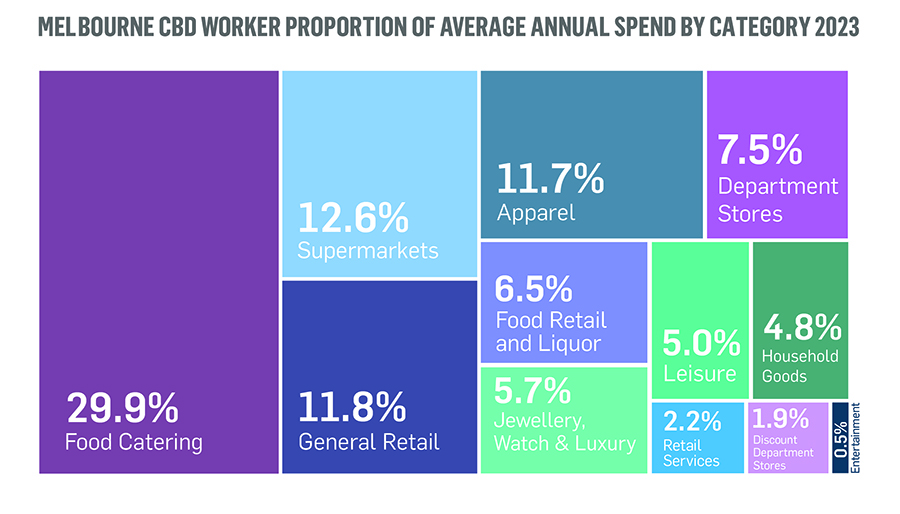

This is particularly pronounced when looking at the retail categories workers are making purchases in when they are in the CBD. Food catering has always been a key category for CBD workers and this has not really changed. Between 2019 and 2023, food catering purchases remained relatively constant (falling ~3% over this period). However, the number of purchases made in other categories grew quite markedly, from 33 per worker in 2019 to 40 in 2023. And this is consistent across almost all categories – only food catering, retail services and department stores have seen purchase-numbers decline. Office workers are actually expanding their CBD shopping repertoire.

The CBD worker cohort remains a very valuable group and a significant opportunity, spending 17% more on retail in total than the broader Melbourne population.

Tourism is the missing piece of the puzzle

With ‘local’ inner-suburban shoppers remaining well-engaged, CBD workers being less influential than conventional wisdom suggests – and still spending quite heavily anyway – and with suburban Melburnians increasingly drawn to the destinational experiences only available in the CBD, the obvious question becomes: What is the upside for CBD shopping centres? The answer is tourism.

Tourist numbers to greater Melbourne in 2023 were likely about 27% down on 2019, according to Urbis’s forecasts based on Tourism Research Australia figures, roughly evenly across domestic and international tourism. Chinese tourism specifically was down well above 50%. According to HMD analysis, visits from tourists accounted for 19% of visits to the retail core in 2019, but only 13% in 2023.

Tourism, especially international tourism, has a disproportionate impact on CBD shopping centre sales. In its 2021 Annual Results, Vicinity Centres estimated tourism accounted for about 25% of Emporium sales in November 2019, with international tourism making up around half of this. A rebound in tourism undoubtedly shapes as a real tailwind for CBD centres.

While all CBDs are different, the Melbourne experience certainly has implications for other Australian cities. Indeed, retailers, such as Adidas, JD Sports and R.M. Williams have moved quickly to establish flagship locations in the Sydney CBD, joining the largest LEGO® store in the world. The expanding luxury footprint, with more to come, in Perth CBD could soon see Murray Street mistaken for Park Avenue. The Queens Wharf and Waterfront developments in Brisbane will likewise add significantly to the destinational appeal of its CBD/city centre. Adelaide, with its ring of parklands, events-focus, river, convention centre and proximity to Adelaide Oval, is perhaps the most similarly conceptualised CBD to Melbourne; the Market Square and Central Market Expansion, alongside continued development of Rundle Mall, will only further increase its drawing power. It is not only the Melbourne CBD that continues to evolve.

Emporium Melbourne

City authorities and industry associations in all states should (and are) take heed of the Melbourne experience – inner city residential development and adaptive re-use, central-area tertiary institutions, nearby cultural and sporting events, and urban design initiatives, particularly biophilic design, drive central city vitality. This vitality both supports, and is supported by, CBD retail.

After suffering more than any other type of retail property throughout the pandemic, there is no doubt 2023 marked a turning point for CBD centres. ‘Experience-seekers’ are leading this recovery, validating retailers and landlords’ focus on unique and flagship offers. The destinational retail uses demanded by this group will likewise appeal to returning tourists and tempt workers to continue to expand their shopping repertoire. After a harrowing period, there is certainly some cause for optimism around CBD retail. What is clear, is that CBDs will continue to transform and shopping centres are well-placed to capitalise on – and drive – this evolution.

This feature article is published in the latest edition of SCN magazine