Shopping centres are now consistently performing well and have a variety of evolutionary opportunities available. In an environment where investors are seeking higher returns, the combination of these two factors is putting retail back on the radar for several groups or attracting the attention of maiden capital.

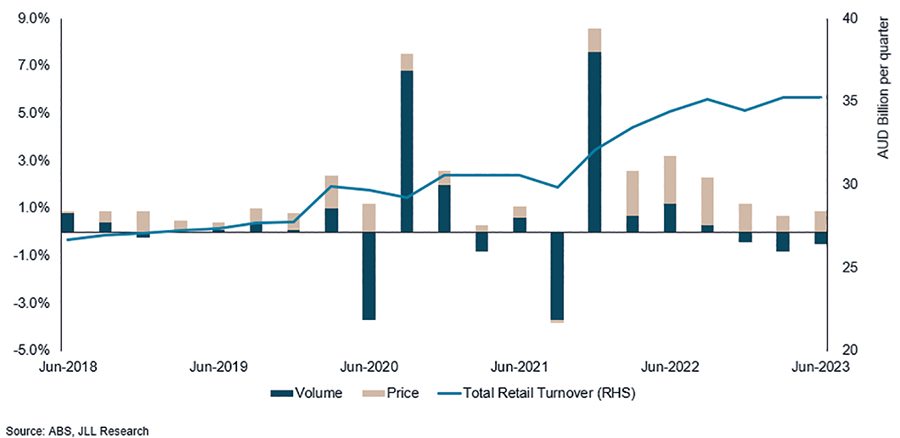

The resilience of the consumer has continued to surprise economists. Consumers are still spending more than $35 billion per month on retail compared with $28 billion per month before the pandemic, a 28% increase.

Despite the RBA raising the target cash rate by 400 basis points to 4.35% since May 2022, retail trade has outperformed market expectations. Of course, the elevated cash rate, which currently sits at its highest point since April 2012, is not immaterial. While higher interest costs on mortgages have been widely anticipated as a headwind, given that a large proportion of low-rate fixed-term mortgages expired in 2023, it has not translated into a material slowdown in retail spending.

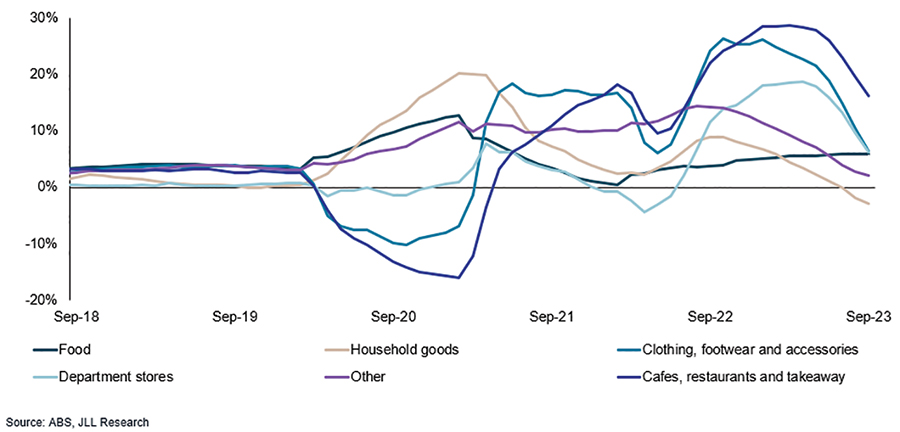

We are now just starting to see some decline in some of the discretionary categories on a month-on-month basis, but far less than expected and the value of sales in those categories remains exceptionally elevated compared with pre-COVID levels.

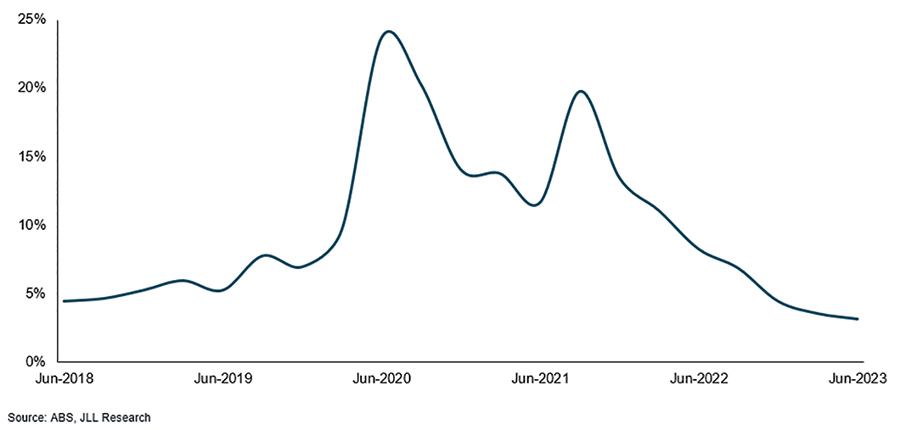

- Figure 1. National household saving ratio

- Figure 2. Total retail turnover volume vs price – by quarter

To date, the national household savings rate, which peaked at 23.7% during the height of the pandemic, has reduced to 3.2%. So, consumers continue to add to the cash pile of savings accumulated in previous years given the savings rate remains positive, providing a buffer for spending and cost-of-living increases.

One of the other factors driving consumer resilience is home equity. The rapid increase in house prices in the past three years has resulted in household wealth creation, typically a strong driver of retail spending.

- Figure 3. Retail turnover growth – by category

- Figure 4. Major retail chain insolvencies – number of stores

Population growth and inflation have also played a role in supporting retail turnover growth. The additional 563,200 people added to the population in the year to March 2023 has provided a boost to sales growth, which is flowing through to higher sales productivity in shopping centres, given the limited supply. Inflation has also been supportive to the extent that higher prices have been passed on to consumers, even though the volume of goods sold has turned negative.

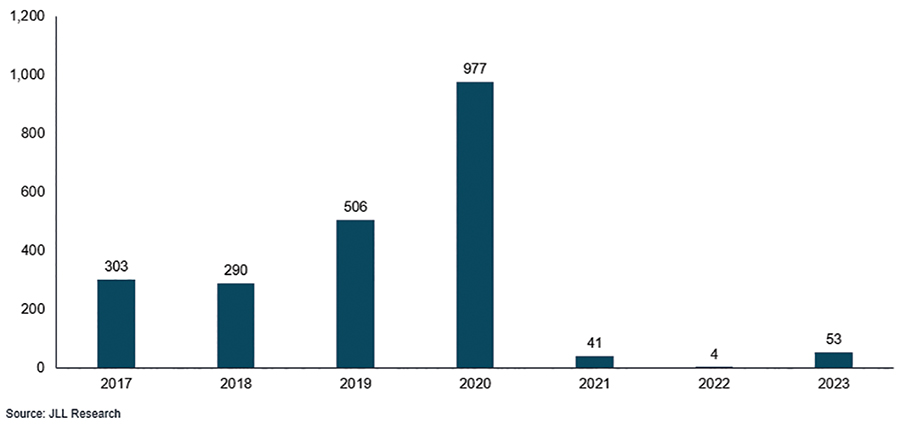

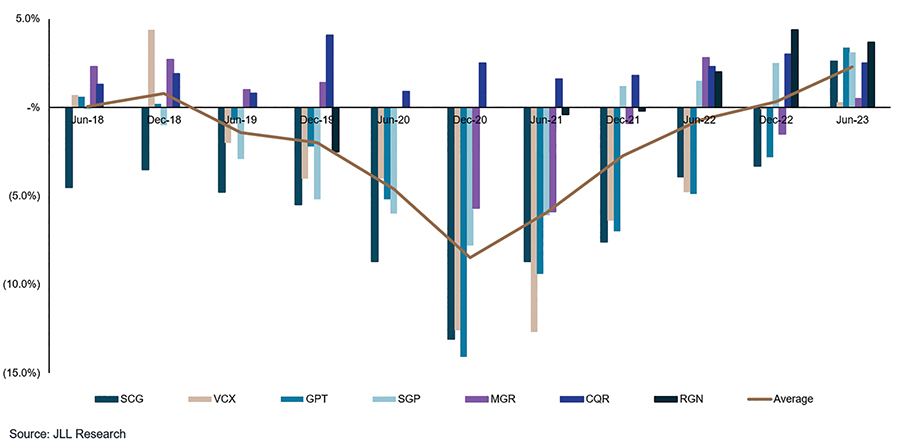

Retailer margins remain healthy, albeit easing. The vacancy rate for regional, sub-regional and neighbourhood shopping centres has eased to 4.3% as of June 2023 from a peak of 5.4% in June 2022. And the number of major business insolvencies remains very low by historical standards. Some larger national brands have demonstrated opportunistic expansion plans. For example, youth lifestyle retailer Accent Group has announced plans to expand its existing network of 821 stores by 50 in FY24. Re-leasing spreads have steadily continued to improve from the low reached in December 2020. In their Q1 2024 operational update, Vicinity Centres reported decade-high re-leasing spreads of +4.5%, and The GPT Group reported +5%.

Figure 5. Re-leasing spreads

Evolution of shopping centres presents a variety of adaptation options

Shopping centres are constantly evolving, from a mix, layout, and alternate-use perspective and the sector is continuing its journey to a mixed-use future. Owners and new investors in retail are regularly looking for ways to improve the customer experience, build tenant longevity and ultimately create a financially sustainable asset. Some of the recent evolutions have involved changing the retail mix to incorporate more entertainment, lifestyle, health uses and mini-major tenants and large-format retailers, as well as social and community uses.

Retail properties can be part of the solution to the undersupply of housing in Australian cities, partly to cater for high levels of inbound migration and population growth. Despite the highest rate of annual population growth (March 2023, 2.2%) since March 2009 (2.1%), dwelling commencements are at their lowest level since March 2013, and residential vacancy rates remain tight in most markets.

Build-to-rent (BTR) is continually discussed as an alternative or additional use for shopping centre sites as most retail assets have a favourable underlying mixed-use zoning and low site coverage. Some challenges for delivering BTR projects remain, particularly around feasibility. However, the current housing supply shortage and limited pipeline is strengthening the investment case alongside possible government intervention on taxes, which may make BTR more attractive.

Another evolutionary direction for shopping centres has been last-mile logistics, given the location of shopping centre sites within close proximity to customers. A range of shopping centres are including various forms of last-mile delivery capability within their footprint nowadays.

As supermarkets continue to move to an omnichannel model – of home delivery, click-and-collect and traditional shopping habits – it will continue to present opportunities to build on-site fulfilment functions.

Retail sector capital seeking enhanced returns

The performance and evolution of shopping centres is drawing interest from a wider range of capital sources, globally.

The improvement in the performance of the retail component of shopping centres post-pandemic has reignited interest in the sector and the impact of e-commerce has been far less than initially feared in 2020. The performance of retail property has been more than just a rebound – but a more sustained recovery, proven over several years.

The diversification of potential new uses, for things like BTR, last mile logistics or even entertainment, is attracting new entrant capital to the retail sector.

For example, Whitestone REIT in the US (owner of a convenience-based retail portfolio of more than US$1 billion) was recently reported to have been approached with a takeover offer by a diversified asset manager, Fortress Investment Group. Furthermore, VICI Properties recently acquired a bowling and family entertainment portfolio in the US for US$432.9 million under a sale-and-leaseback arrangement for 25 years with a reported cap rate of 7.3%. Lastly, Continental Realty recently acquired a shopping centre in Orange County for US$110 million in November 2023, for reportedly $10 million less than the property was previously acquired in 2015. It represents the second shopping centre acquired for its closed-end retail opportunistic fund, with a representative commenting on the successful performance of the centre and value-add potential.

It’s an exciting time for shopping centres. There seems to be an opportunity for investors with flexible mandates, creative vision and active capabilities to capitalise on the evolution of shopping centres as the lines blur across industries, tenant types and asset classes.

This article authored by Andrew Quillfeldt and Jacqeline Darwis is published in the latest edition of SCN magazine.