New players, executing different investment strategies in Australia’s retail investment market will lead to continuing elevated transaction volumes. However, surpassing the 2021 record of $13.4 billion of retail transactions will be unlikely in 2022. That’s the outlook view from JLL in its ‘Retail Investment Review and Outlook 2022’ Report.

JLL’s Joint Head of Retail Investments – Australia, Sam Hatcher said, “We’re working with a broader cross section of investors than in previous years, ranging from core funds, listed groups to private investors for an even more diverse range of asset types.

“The legacy of ownership consolidation in retail is being unwound with new players executing different strategies, a theme which is leading to elevated levels of transaction activity.

“We’re likely to see bifurcation in views and investment strategies. For some capital sources, defensive preservation plays are likely to still be prevalent in an uncertain global environment, while others will advance counter-cyclical value-add strategies within retail,” said Hatcher.

Changing ownership profile

According to the Report, the retail investment market is characterised by a changing ownership profile with many major institutional long-term holders of retail assets continuing to refine their exposure and narrow their focus to smaller portfolios. Meanwhile, a range of relatively new entrants are building significant scale, primarily syndicate businesses raising retail or wholesale capital, or in some instances, a combination of both. For the new market entrants, the strategy is underpinned by counter cyclical timing given the correction in asset values, the attractive entry yields, and ability to extract value from alternate uses.

JLL’s Senior Director of Retail Investments – Australia, Nick Willis said, “There continues to be new capital seeking to enter the retail sector, attracted to the relative returns when compared to other sectors. These investors are taking advantage of the liquidity in the sector following a number of institutional owners with major retail portfolios that have a stated strategy to reduce their allocation to the retail sector.

“However, those strategies are now relatively progressed and some major owners are close to achieving their targets, with increased supply of assets being offered for sale in Q4 2021 and so far in 2022 for larger scale regional shopping centres, while owners look to hold more core neighbourhoods and sub-regionals,” said Willis.

Macquarie Centre, NSW

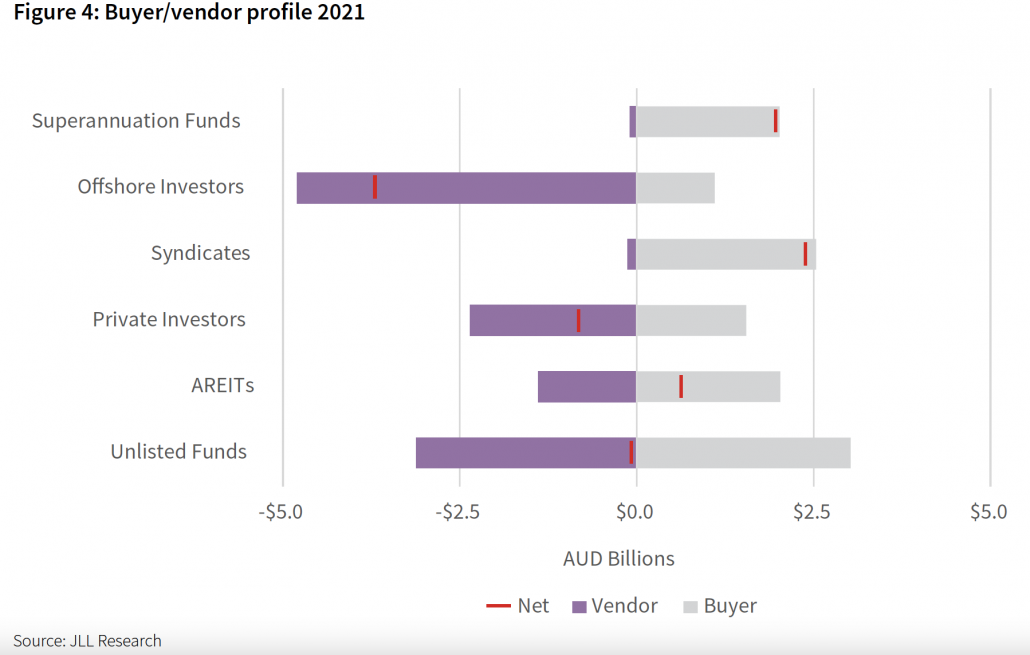

Syndicators have been one of the most active sources of capital for retail in the last two years, with over $2.5 billion worth of acquisitions in 2021. A-REITs continued to purchase assets selectively and were net buyers in 2021 ($635 million).

Offshore investors were significant net sellers of retail assets in 2021 of approximately $3.7 billion. Excluding the impact of the AMP Capital ACRT transaction, sales by offshore investors were almost 2.5 times greater than the volume of acquisitions.

JLL’s Joint Head of Retail Investments – Australia, Jacob Swan said, “Offshore investors are nevertheless undertaking more market due diligence and strategy work on the Australian retail value proposition – after having been relatively dormant for the last few years. Acquisitions by offshore groups were approximately $1.0 billion in 2021, marginally below the 10-year average but in-line with the 15-year average.”

JLL’s Senior Director of Retail Research, Andrew Quillfeldt said the retail investment outlook remains strong for 2022, being driven by positive retail spending, with interest rate impacts the biggest factor this year.

“Investors are now anticipating an increase in short and long-term interest rates to contain rising inflation. However, spreads to the risk-free rate in the retail sector are wider than their historical average and the fair value range, suggesting there may be limited pressure on pricing as a result of the wide buffer.

“Many of the ingredients which drove strong levels of transactions in 2021 still exist in 2022. The capital markets remain supportive in terms of the availability of equity and debt. The value proposition for retail relative to other assets classes remains compelling from a valuation and pricing perspective.

“The labour market remains very supportive of retail spending and housing has remained a tailwind given rising wealth (asset prices) and renovation activity (household goods spending),” said Quillfeldt.