What happened to the shopping centre industry last year in terms of property transactions? You could be forgiven for thinking not much during a period of lockdowns and border closures. The reality is that it was a record year!

This article by the JLL Retail Investment Team forms part of a special Investment Review feature first published in SCN’s Big Guns 2022 edition.

Andrew Quillfeldt, JLL

By Andrew Quillfeldt, Senior Director, Research – Australia, JLL

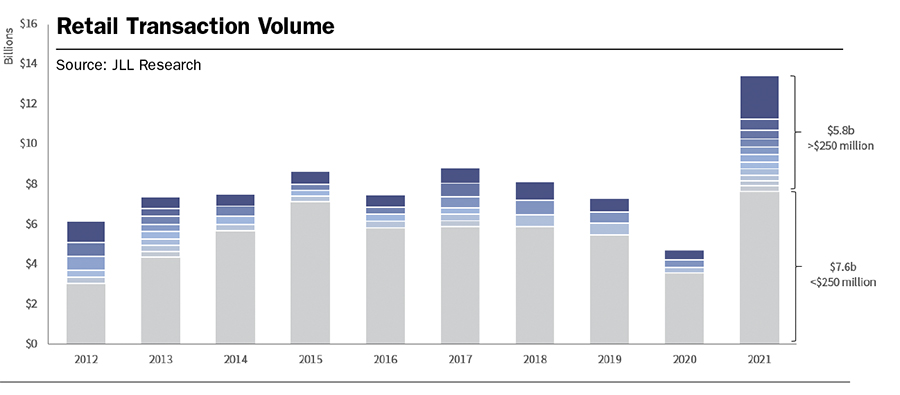

Renewed investor confidence translated into record levels of activity in 2021 ($13.4 billion) – and it was a record year in various measures. It was a record year for large and small transactions (above and below $250 million).

We recorded 11 transactions over $250 million in 2021, compared with three to five in a typical year.

The value proposition of retail relative to other sectors, combined with the recovery in underlying fundamentals, reset in capital values, and long-term potential to extract value from other uses were key contributors to the uplift in demand for major assets. Furthermore, the outlook for the economy continued to strengthen, despite the lockdown-related speedbumps in the recovery profile. Notably, the labour market continued to tighten close to the level of full employment.

Lockdowns continued to highlight the resilience of underlying retail conditions in terms of the swift rebound in spending as restrictions are eased and in terms of occupancy. Vacancy rates moved up by less than 1% in non-CBD shopping centres during the pandemic. Landlords managed to retain tenants by providing rent relief in exchange for extended leases. Some of those extended leases negotiated in 2H20 are now coming up for expiry in 1H22, and early indications suggest many are likely to be renewed.

JLL Research

Leasing activity is higher than normal, and with shopping centre vacancy rates broadly stable, it suggests a reshuffling of tenants between centres, albeit not always evenly, which is accelerating divergence. Retailers have faced the challenge of staff shortages, product shortages from supply chain disruption, rising costs, unpredictable lockdowns and volatile trading conditions. Fortunately, the economic environment has been supportive of strong retail spending growth, which grew by 5.6% in 2021. A tight labour market, a drawdown on high levels of household savings and travel cost savings were among the key drivers. Many of the economic ingredients fuelling retail spending growth are likely to remain supportive in 2022. The key risks will be the outlook for interest rates, residential prices and the subsequent impact on household wealth and consumer confidence.

Investor confidence in the outlook for retail assets continues to improve. The buyer profile is broadening along with risk appetite.

There continues to be a wider cross-section of active capital for retail assets. While syndicators continue to be a major driver of activity for the past two years, traditional core capital sources of wholesale funds, superannuation funds and, to a lesser extent, offshore investors returned to the retail sector.

However, offshore investors and wholesale funds were active on both sides – in terms of both acquisitions and disposals. The reshuffling of assets reflects different pools of capital (sometimes by the same Investment Manager) across different funds with different investment risk profiles.

JLL Research

Capital partnering has re-emerged as a major theme, with $5.7 billion worth of co-investments and part-share transactions recorded in 2021. Many institutional owners, not just within the retail sector, have stated plans to grow their third-party funds management operations. We anticipate there to be a pipeline of part-share capital partnering opportunities as institutions diversify their exposure to individual assets.

With some indirect investors, which were traditionally seen as more passive capital (i.e. without in-house asset management expertise), now seeking more direct control over the assets they have exposure to, there may be a shift from pooled wholesale funds to direct co-ownership stakes.

Nick Willis, JLL

By Nick Willis, Senior Director, Retail Investments – Australia, JLL

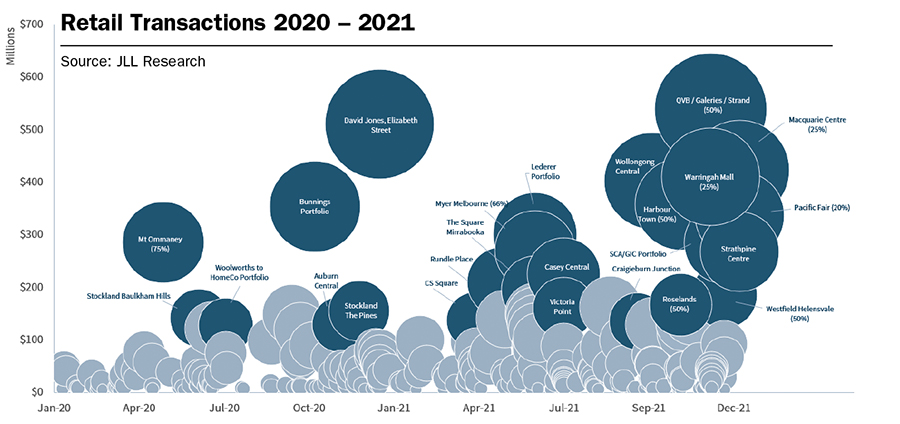

Australia led the global stage for major large-scale retail transactions in a post-pandemic world. The offering of Macquarie Centre (25%) and Pacific Fair (20%) for a combined $760 million were among the first formal super-regional assets to be offered globally and a key litmus test for investor confidence in the sector at a major institutional level.

Major domestic and global investors emerged from hibernation and engaged in the opportunity. The sale of these significant assets, in addition to other regional sales such as Wollongong Central, Roselands and Casuarina Square, has instilled confidence back in the market for liquidity, which is driving an increase in available supply in 2022. Conversely, the traditionally liquid part of the market (neighbourhood and smaller sub-regional centres) is increasingly becoming constrained as vendors look to hold rather than sell.

Casuarina Square, NT sold for $418 million

For larger assets, buyers were able to look through the short-term volatility in trade from lockdown restrictions and identified value and an opportunity in the long-term mixed-use potential. This is a key thematic in the sector more broadly, attracting new entrant investors with diversified skillsets whom have recognised the value in the underlying real estate of shopping centres, over-and-above the current income streams.

A select few offshore investors participated in the retail sector in 2021. However, those that did participate made significant allocations with high conviction.

Link REIT was a major contributor with its Sydney CBD acquisition of a 50% share in the QVB, Galeries and The Strand, along with GIC’s partnerships for neighbourhood and convenience retail with SCA Property Group and Centuria. Offshore investors have been restricted for the past 24 months in terms of travel and inspections, giving local managers and investors an advantage. However, we anticipate a significant increase in their participation this year as international travel reopens. It is clear that these offshore investors recognise the safe haven nature of the Australian market and resilience in the sector compared to the US and European markets.

- Macquarie Centre, NSW

- Macquarie Centre, NSW

In 2021, our team was involved in more than 40 transactions amounting to over $7 billion worth of underbidder capital directed to the sector. While we have seen a significant return in capital allocation to the sector, investors are still highly discerning with asset selection.

Neighbourhood and convenience-based sub-regional centres continue to attract the greatest weighting of core capital given the sector’s resilience. The Large Format Retail (LFR) sub-sector has been a major out-performer attracting a significant increase in capital, drawn to the land rich nature, as a proxy to industrial exposure and the strong underlying performance of the sub-sector. Yields in the LFR sector have compressed 105 basis points (bp) to 5.98% nationally during the past 12 months to 4Q21.

Sam Hatcher, JLL

By Sam Hatcher, Senior Director, Joint Head of Retail Investments – Australia, JLL

The discussion around potential interest rate rises in 2022 and 2023 is dominating headlines across the media. We anticipate the interest rate rises to have some impact on the shopping centre investment market – albeit minor. The Interest Cover Ratio is at historical highs, with many buyers having secured assets with Interest Cover between four to six times. Therefore, even a 50-75bp rise during the course of 2022 wouldn’t have a material impact on the ability to service debt, particularly given institutions have reduced gearing, extended debt maturity and diversified lending sources. In addition, shopping centres remain the highest yielding asset class within commercial property, so there remains a considerable spread or buffer between the cost of funds and yields.

Australian homeowners have benefitted from the strongest growth in asset prices ever recorded. The ‘wealth effect’ from rising asset prices supports discretionary spending.

However, approximately one million homeowners in Australia have never experienced a rate rise and, therefore, any considerable increase may impact their willingness to spend at the same pace as witnessed during the past 12 months.

Marketown Newcastle, NSW sold for $150.5 million

Although Australia is moving into a tightening interest rate cycle like many other countries, the economy is recovering ahead of expectations, so it is no longer appropriate to have emergency monetary policy settings. Upward movements in the official cash rate are generally a symptom of a strong economy generating employment and real wages growth.

On balance – we remain very bullish on the outlook for the performance of shopping centres as we enter a period of interest rate tightening.