A dominant and convenience-focused sub-regional shopping centre situated in the epicentre of one of Australia’s most coveted locations hits the market, presenting an exceptional opportunity to acquire a trophy Sydney shopping centre.

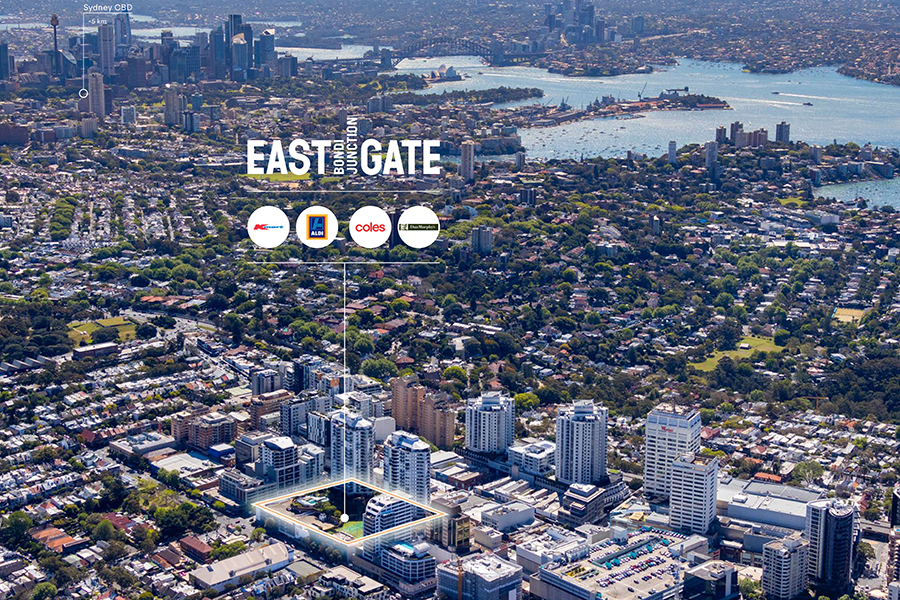

JLL’s Nick Willis and Sam Hatcher, alongside Stonebridge’s Carl Molony, Philip Gartland and Justin Dowers, have been exclusively appointed for the sale of Eastgate Bondi Junction. The iconic retail destination owned by ISPT is strategically located in the heart of Bondi Junction, a mere stone’s throw from the Bondi Junction train station and just a short drive away from Bondi Beach.

Eastgate Bondi Junction boasts an impressive non-discretionary tenant mix and is anchored by national retail giants Coles, ALDI, Kmart, and Dan Murphy’s. Covering more than 15,000m2 of gross lettable area and offering convenient access to 887 parking spaces, this prestigious shopping centre is truly a cornerstone of the eastern suburb’s community.

Nick Willis said, “Sydney’s eastern suburbs is one of the most coveted investment destinations globally. Assets of institutional quality like Eastgate are rarely if ever, traded. The term gets thrown around a lot in our industry, however, this is a once-in-a-lifetime opportunity to acquire and control one of the best-performing and premier convenience centres in Australia.”

Sam Hatcher echoed this sentiment, noting that there are only three other convenience-based assets of comparable quality in Sydney’s eastern suburbs, one being owned by Double Bay Council. He also highlighted the asset’s exceptional performance.

“The centre supports strong trading fundamentals with the specialty tenants producing more than $14,800/m2 in sales, some 76% above the industry benchmark. In addition, recent upgrades, including a full façade refurbishment and internal enhancements, have further heightened the centre’s position in the market,” he said.

The centre is positioned in the heart of Bondi Junction and is surrounded by a catchment unlike any other in Australia. Within a two-kilometre radius are affluent suburbs like Double Bay which was, according to the Australian Taxation Office, Australia’s wealthiest suburb from 2020 to 2021. Further, median house prices for other surrounding suburbs such as Point Piper are $10 million, Woollahra $5.2 million and Bondi Beach at $4 million. This unparalleled wealth underpins the productivity and long-term retail spending potential of the catchment and asset.

A unique opportunity to acquire an irreplaceable piece of retail infrastructure in one of Australia’s most affluent corridors

Stonebridge’s Carl Molony emphasised the broad appeal of this asset, stating, “We are expecting strong engagement from not only offshore investors but also local investors who see this as an opportunity to acquire a generational investment for legacy buyers and family offices. Given the limited number of tenants and the asset’s outstanding performance, it can be easily managed by sector-agnostic buyers who are not traditional shopping centre owners. Further to this, the centre provides additional value-add potential through further tenancy enhancements and long-term conversion opportunities.”