2017: Riding the chameleon

Retail is a chameleon, always changing to survive and thrive in the prevailing economic and social environment.

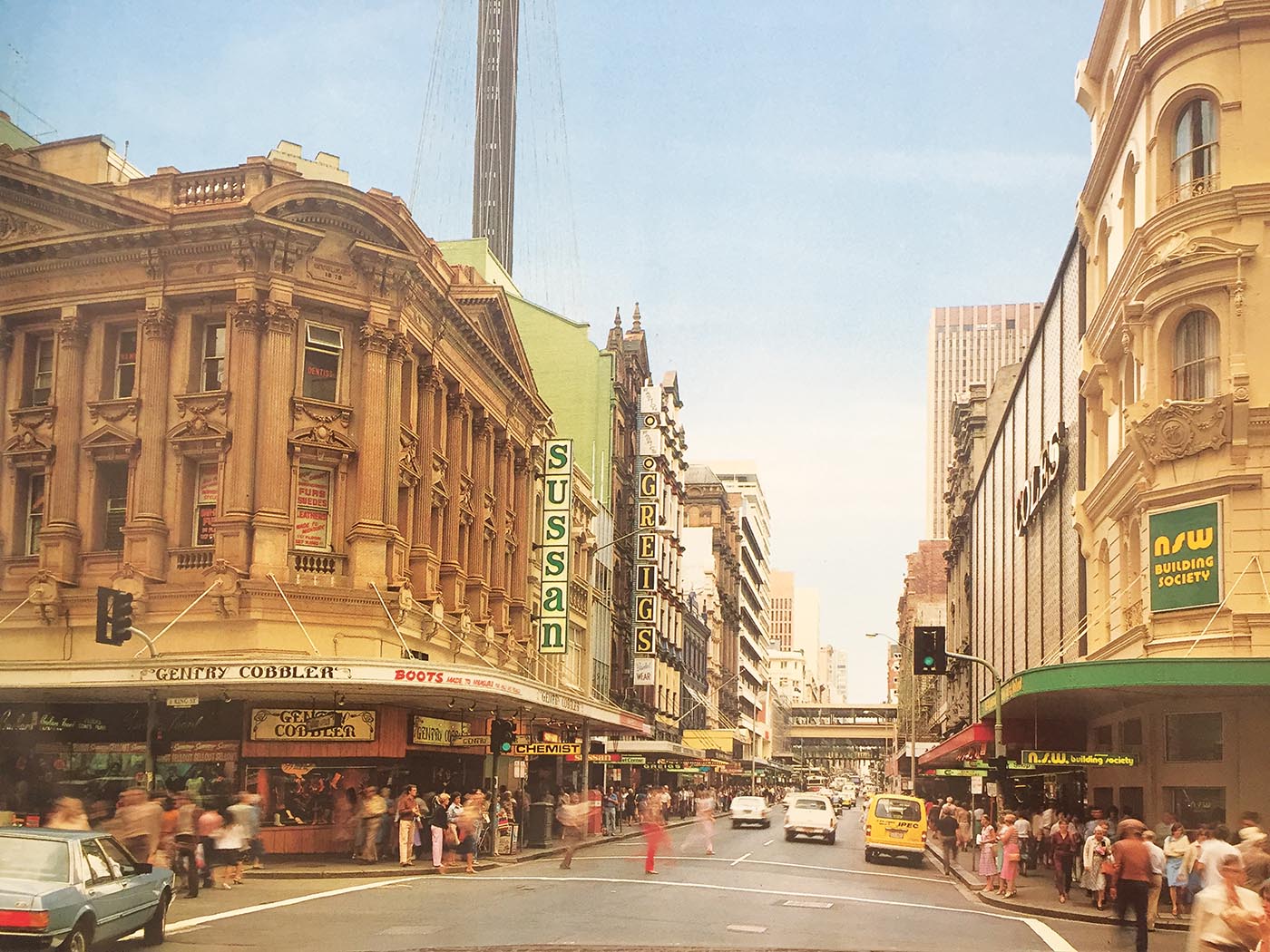

If you don’t believe me, below is how Pitt Street Sydney, south of King Street, looked when The Clash was ‘Rock(ing) the Casbah’.

This image is courtesy of Sydney: Then and Now, published by Golden Press in 1984, with a foreword by Neville Wran. I found it sitting unloved and gathering dust in my dentist’s waiting room – the coffee table book, not the former NSW Premier – and yes, my dentist really does need to update his reading material. It was originally intended to contrast the grainy silverplate photographs of colonial Sydney streets against the modern metropolis we had created by, ahem, 1984 but what struck me most was the transformation of our cityscape over the last 30 years.

- Pitt Street Mall, Sydney – 1984

Given Pitt Street Mall’s evolution into one of the most productive retail strips on the planet, it’s easy to wonder ‘what were they thinking back then?’ but the retail was absolutely appropriate to the era and the customers who shopped there at the time. It usually is. The most dramatic shift between then and now isn’t so much the retailers, but the actual pace of change.

No prizes for guessing that this transformation, this constant need to evolve or perish, is being largely driven by ‘the internet of everything’, which will continue to accelerate over the next few years.

This is driving two very interesting and important outcomes: some categories of traditional retail are moving closer to the internet, primarily driven by the constant innovations of retailers themselves, while other categories continue to thrive in the real world.

Most successful retailers are combining their respective physical and digital retail presence to create more immersive, price-competitive experience with faster fulfilment capabilities. This is not an optional extra or nice to have. ‘Phygital’ retail has become the new norm; it has become table stakes. Customers now expect your multiple touch points and customer service capabilities to align seamlessly.

If there is any residual recalcitrance to the internet of everything, and I suspect there is, the much-feted arrival of Amazon Go in Australia will soon boot camp us all into shedding those last few remaining pounds that may be slowing us down.

As an owner, operator and developer of shopping centres across Australia, we have an important role to play to make our centres match fit and ready to play in this brave, new world.

We’re working more closely with retailers than ever before to fine-tune what I would call real ‘data-based’ (as opposed to database) decision making. From a macro perspective, big data helps us to optimise the retail mix to maximise the productivity of our centres, and enables us to share insights with our retailers on consumer trends and preferences in any given trade area.

It is within our centres that these two worlds of digital and physical retail collide.

Stockland Wetherill Park is a great example of these convergent and divergent worlds. We undertook our latest, major redevelopment of Wetherill Park between 2014 and 2016, investing $228 million at cost to dramatically change the look and feel of the centre.

As we all know, the secret to successfully managing a shopping centre portfolio is to know when and what to buy; when to hold an asset; when to remix the retail; and when to undertake a minor refurbishment or major redevelopment.

At Stockland Wetherill Park, 34 years after we first opened our doors, we now have a 12-screen Hoyts, JB Hi-Fi Home, Fit n’ Fast gym, doctors, physios, dentists, teeth whitening salons, day spas, nail bars, hipster barbers and, of course, Target, Big W, Woolworths and Coles but the all-pervasive, decentralised anchor is most definitely fresh, ready to eat and enjoy, food.

The new and improved customer experience at Wetherill Park is best defined by casual dining with our modern twist on laneway-style street food vendors and our separate, new 800-seat indoor-outdoor casual dining precinct.

‘The Grove’ features 38 new restaurants, cafes and food operators, and is flooded with natural light from north-facing floor to ceiling windows, which we can concertina open in fine weather at the push of a button. We’ve more than doubled our fresh food and casual dining offering throughout the centre and more than 21% of the retail mix is now focused on food.

Our customers’ response to the ‘new’ Wetherill Park has been nothing short of sensational in every sense. As a landlord, we’re used to experiencing a period of stabilisation as customers reorientate themselves with the new retail offer and it’s not unusual for any major expansion to see a slight dilution of trade. However, at Wetherill Park, our ‘food as anchor’ strategy has lifted the performance of the entire centre. We’ve almost doubled the number of specialty retailers and achieved good growth in productivity per square metre of GLA.

But here’s the kicker. If we tried to build the centre that we now have at Wetherill Park in 1983, it would have failed spectacularly. To invoke another Clash classic of the time, retailers would have been justifiably asking: ‘should I stay or should I go?’ Why? Because the trade area was not ready for the ‘new’ Stockland Wetherill Park in 1983.

When we originally built the centre, it was on the outer urban fringe of western Sydney, surrounded by small acreage land holdings, mainly comprised of market gardens and a few of the first homes to spring up in the area on quarter acre blocks. Stockland Wetherill Park circa 1983 was anchored by one supermarket, one discount department store and a handful of specialties. It did well, and we’ve gradually grown the asset and its retail offering over the last four decades.

This brings me to the next major trend that we’re expecting to play out over the next few years.

For much of my 30-year career, I’ve worked with a large number of exceptionally talented colleagues to bring shops to the people. However, if the demographic predictions of longer life expectancy and longer working lives are true, I may be far more likely to spend the next 30 years of my career bringing people to the shops.

When it comes to creating new retail floor space and much-needed new homes for Australia’s growing population, we’re increasingly finding that the only way to go is up. This is precisely where our diversified property development capabilities will come to the fore.

We’re already planning to re-enter the mixed-use residential and retail development market, when the time is right. To be frank, the GFC notwithstanding, the main reason we took a hiatus from this market after completing Stockland Balgowlah and Stockland Cammeray was that these developments were ahead of their time; most local councils of the day weren’t ready for them.

Stockland Balgowlah has 13,000m2 of mixed use development, including a full-line Coles supermarket, Harbord Growers Market, Platinum Fitness First and 60 specialty stores on the podium beneath and adjacent to 240 residential apartments. Both Balgowlah and Cammeray have stood the test of time over the last decade – and the locals love them in equal measure. Today, various state governments and local councils in all capital cities, to their credit, are far more amenable to mixed-use development.

At the end of October last year, we submitted a Development Application as part of a proposal to develop residential apartments, a laneway cafe and restaurant precinct and a village green in the heart of Toowong, 5 kilometres south-west of the Brisbane CBD.

Our proposal, lodged with Brisbane City Council, is seeking approval to build a total of 530 new apartments in three buildings. Each of the three buildings could be up to 25 storeys, comprising one, two and three-bedroom apartments. The ground floor of the proposed development will include an activated laneway precinct comprising up to 2,000m2 of boutique retail, cafes and casual dining restaurants that will respond to, and enhance, the relaxed, sub-tropical lifestyle of inner city Brisbane. We’re also proposing to transform the north-east corner of the site into a village green with outdoor seating and landscaped gardens for public recreation and relaxation.

We have similar plans for a site we own adjacent to Stockland Merrylands, and received DA approval from Cumberland City Council just before Christmas. We’re proposing to build more than 500 new apartments across five buildings, which will be integrated into a thriving new city centre, designed around an activated laneway precinct comprising around 8,000m2 of retail, restaurants and cafes.

These two developments will have something very important in common with all of our shopping centres, all of our residential communities and all of our retirement villages. They will deliver a strong and cohesive sense of community.

We’re all human and, as social beings, we all want and need to live in safe, desirable, healthy communities. Our business is all about community creation; it’s about creating places where people live, work, shop, eat and socialise.

This year, we’ll continue to progress our active retail redevelopment pipeline, which currently comprises more than $1.2 billion worth of work in hand. We will steam ahead with our $412 million dollar redevelopment and expansion of Stockland Green Hills in the NSW Hunter Valley and we’ll continue to remix our retail and pay particular attention to improving our various Entertainment and Leisure Precincts at places like Rockhampton, Shellharbour and Wendouree.

We all know people who are eminently adaptable to their environment. However, if you watch carefully or read through enough dusty retail property portfolios, you may notice that the real chameleon is the retail and commercial property that surrounds us all. It will continue to change and evolve again this year and it will perpetually thrive and inspire.