2017 is a year where we need to remain disciplined as an industry and have continued faith in the resilient retail industry which underpins our successes in managing shopping centres.

Our retailers

Last year I discussed that Australian retail sales in 2015 increased 4.2% compared to the previous year with December 2015 month on month sales at 4.0%. This performance gave many cause for great optimism for 2016. 2016 retail sales by comparison to 2015 grew by 3% with early December month on month numbers showing -0.1%.

The drivers behind these results remain:

1. Grocery price deflation

2. Subdued consumer sentiment

3. Growth of online.

Noting that the 5-year average is ~3.8% (period ending 2015), the trends continue to point to a shift in the retail landscape. The consensus amongst economists also tend to support the ‘lower for longer’ theory and our retailers are adjusting to the drivers listed above.

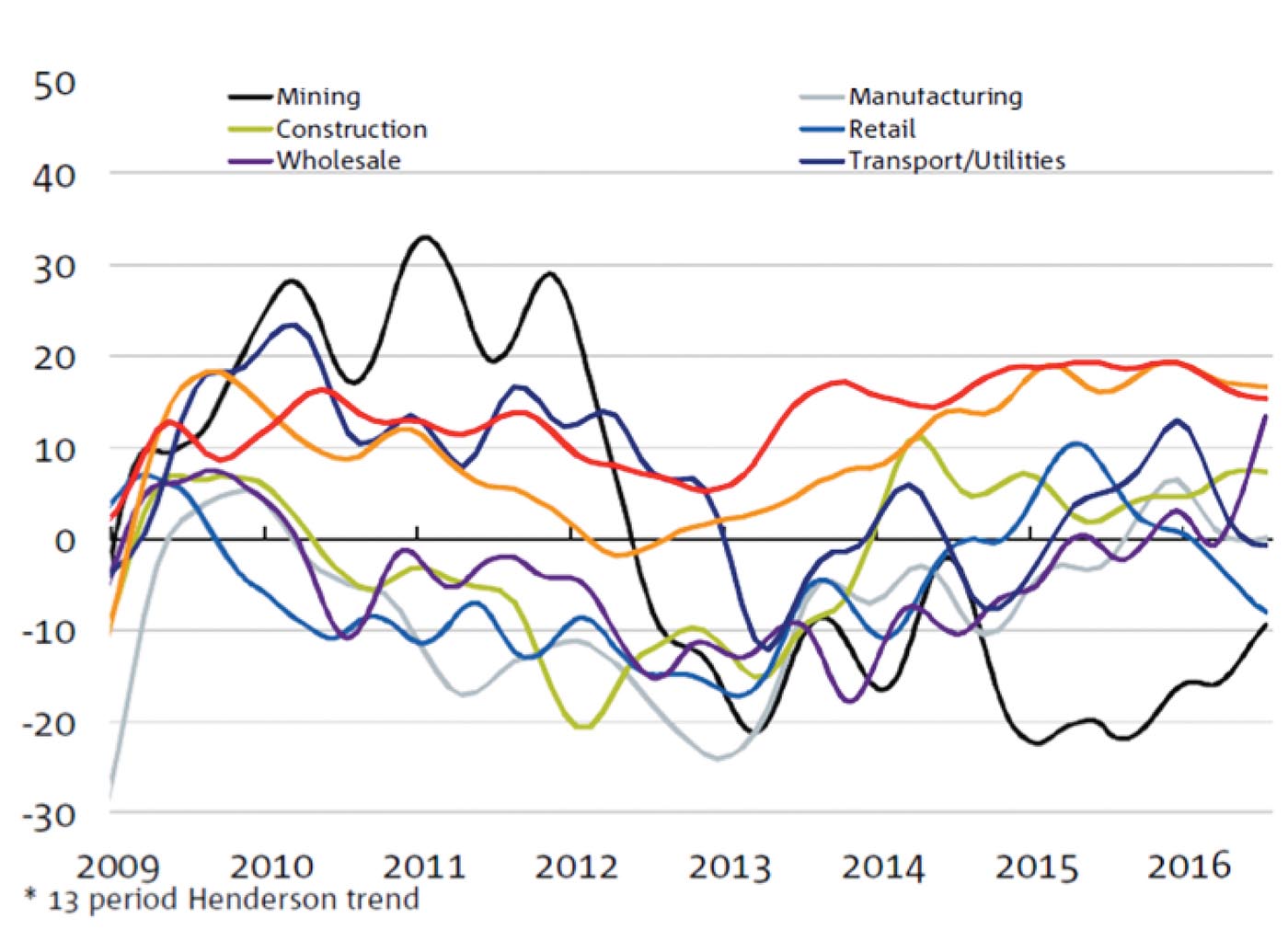

The NAB business conditions by industry provides some good insights on where the market is heading.

These economic conditions coupled with subdued consumer sentiment have led to a significant year for many retailers, not all for the right reasons.

This was a year where we saw iconic brands such as Dick Smith, Pumpkin Patch, Payless Shoes, Marc’s enter into administration and / or otherwise cease trading. Indeed, depending on which analyst report we read, there were more retail collapses this year than any year since the GFC. That is not to say it is all bad news! Many new entrants have joined the market. As the Austrian American economist Joseph Schumpeter elucidated in the beginning of the 20th century – in economic cycles there is always a “gale of economic destruction” that “incessantly revolutionises the economic structure from within, incessantly destroying the old one, incessantly creating a new one”. While Schumpeter referred broadly to macroeconomic movements, the principal applies in industries also. The gale we are now facing with increased competition is seeing the better retailers adapting to changing consumer habits succeeding and supplanting previous retailers. This is not a new phenomenon.

To ensure we remain adaptable to this changes, its important we continue to have proactive and meaningful relationships with our retailers. At SCA our account management approach allows our internal leasing team to study and learn our retailers requirements in depth thereby finding solutions for their needs in our diverse portfolio. This trend is echoed in our industry. The Shopping Centre Council of Australia, admirably led by Angus Nardi and Kristin Pryce, also acknowledges the importance of strong engagement with the retail sector and continues to foster good and collaborative relationships with that sector’s representatives on a range of issues. This is a major step forward and builds on the symbiotic nature of our respective sectors. On a slightly different note, a particular highlight of 2016 was the Shopping Centre Council’s Industry Lunch which, I’m told, was attended by around 600 people. For an industry that works incredibly hard and delivers a lot, having a dedicated opportunity to come together and celebrate our achievements and our industry leaders was a great addition to the calendar.

While not immune to the effects of the retailer churn, at SCA we weathered the effects of these changes well. Out of our 1200 speciality shops we had only 4 fall overs – all since replaced. Our relationships with our retailers allowed us to ensure our tenancy mix is forward looking.

NAB Business conditions by industry

Our people

Our performance at SCA this year reflected our unwavering commitment to ensuring we manage the best convenient shopping centres in the catchments they reside in. The customer doesn’t recognise the difference between neighbourhood v sub-regional v regional – they recognise convenient and destination experiences. Both remain relevant in a consumer market which demands instant gratification and is permanently connected to their social networks. For our centres – convenience is paramount.

Active Centre Management remains the most effective way of us to connect with our retailers and our customers. This is especially vital for a geographically diverse portfolio such as ours. While vertical integrated models remain the preferred amongst most REITs, these do not necessarily provide the most effective form of management for small convenient shopping centres. Retail is detail.

Last year our review of centre management led us to localise centre management with agent partners that were pre-eminent and most connected in the local communities our centres reside in. Remote control management from a head office is never as effective as a team that cares about its centres, its communities and its customers at the coal face. So as to capitalise on the economies of scale benefits that 74 centres has on expense management – we engaged a national facilities management partner to manage procurement for us. A standardised national finance platform ensures efficient reporting and financial management and underpins the performance of the business through detail financial rigour.

We are pleased to partner with a diverse group of property managers including Colliers, Knight Frank franchise offices regionally, Race Property and Comac. Knight Frank Australia manages Facilities nationally. Local know-how and national economies of scale give us a balanced approach to managing an asset class that is geographically diverse in an efficient and cost-effective manner.

Happily this structure allows our head office to remain lean and agile – focused on strategic value, growing top line revenue and ensuring our local teams have the tools they need to drive asset performance.

Our performance

Our specialty and mini-major tenants continue to perform strongly, again recording healthy annual sales growth, despite the continuing subdued sales growth from our supermarket anchors. Our young centres have a lower specialty rent per square metre than more mature centres, and our average specialty occupancy cost is a sustainable 9.7%. Our leasing spreads are 7 – 8% and comparable NOI growth of 2.9% was pleasing which we expect to continue to generate comparable earnings growth as we progress through our first rent renewal cycle from FY17 through to FY20.

We completed the redeployment the sale of our New Zealand portfolio and are now are exclusively focussed on the Australian market. In the last 6 months, we acquired 5 convenient shopping centres. This asset recycling is consistent with our strategy of selling lower growth standalone assets and redeploying funds into higher-growth domestic supermarket-anchored shopping centres.

While the competition to acquire quality neighbourhood shopping centres has increased, and yields continue to firm, we are confident that we can continue to leverage our relationships in and knowledge of the sector to source further off-market transactions that meet our investment criteria.

We continue to take advantage of the development opportunities in our portfolio. Construction has commenced on the $20.2 million expansion of Kwinana shopping centre including the introduction of Coles as a third anchor tenant. Construction has also commenced on the $19.6 million project to build a new Coles-anchored neighbourhood shopping centre at Bushland Beach. Both of these projects are expected to complete in first half FY18. Overall, we have identified around $150 million of development opportunities in our portfolio which we plan to complete progressively over the next five years.

Our disciplined approach to our business extends to our prudent capital management. During the period we increased the A$MTN notes on issue by $50 million, we cancelled some interest rate swaps in conjunction with the sale of our New Zealand assets and we reactivated the distribution reinvestment plan. The weighted average cost of debt has reduced to 3.6%, the weighted average term to maturity of our debt is 5.1 years, 70% of our drawn debt is fixed or hedged, and gearing is 31.0% which is at the lower end of our target range.

Finally, during this current half year we look forward to launching our second retail fund, “SURF 2”, (SCA Unlisted Retail Fund) which will acquire two of our non-core assets, being Katoomba Marketplace and Mittagong Village, for $54.9 million.

Our communities and their safety

Shopping centres in this country remain central meeting spaces for our communities. At SCA we estimate over 100 million customer visitations occur at our centres per annum alone. To ensure that we provide safe places for our customers to shop, for our contractors and people to work – focus on robust safety practices is paramount. Over the last year, we reviewed our entire safety framework and refined our practices. This is part of a continual improvement in the amenity we provide our customers.

Happily, this focus is mirrored throughout the industry. Customer safety is an issue that all property owners should address with the utmost importance. Each group operates differently – and if we can share learnings amongst ourselves – we can continually improve the service we provide our customers.

The Shopping Centre Council, under the direction of its Board, has also been working across the sector to build a good foundation for ongoing collaboration about the operational safety of shopping centres. There is now a framework in place to guide how owners and managers can learn from each other over time. This will start to roll-out over the next 12 months and SCA will be an enthusiastic participant.

In addition to our focus on safety, we will be implementing our Stronger Communities initiative. This program is focused on strengthening ties within our communities by providing meaningful support and initiatives that enhance the wellbeing of our patrons.

I have no doubt that with an integrated approach to enhancing value from each asset by embedding them in their communities, 2017 will be another great year.