Demand for core assets is at a historical high

Investor demand remains very strong for core assets from domestic and offshore capital sources. Demand continues to outweigh the supply of core investment product, resulting in surplus capital which is yet to be deployed and driving competition-led yield compression.

Yields for premium assets are now at or below the previous low reached in 2007. The pool of assets which offer defensive cash flows and strong income growth has shrunk since 2007, leading to a greater focus on fewer ‘strong’ assets.

Transaction activity remained very high in 2016 at $7.3 billion, although it was down by 18% from the all-time record of $8.9 billion in 2015. CBD and sub-regional shopping centres dominated the investment activity in 2016. CBD transactions reached a record high of $1.9 billion, driven by major sales such as David Jones Market Street for $360 million, MidCity Centre (75% share) for $320 million, St. Collins Lane for $247 million, Myer Bourke Street (one-third share) for $151.3 million and Carillon City for $140 million. The sale of a major portfolio ($841.4 million) by Vicinity Centres in May 2016 was a major driver of the total sub-regional centre volume in 2016 ($2.1 billion).

Global real estate allocations are rising

There continues to be a global portfolio re-allocation towards direct real estate. The latest ANREV Investment Intentions Survey found that $57.3 billion (USD) is expected to be invested into unlisted real estate in 2017, globally, with approximately 18% or $10.3 billion (USD) planned for Asia Pacific. Sydney and Melbourne were listed as the top two investment destinations within Asia Pacific, followed by Tokyo. The survey also found that 58% of investors from the region were focused on core assets, much higher than the 28% of European investors and 26% of North American investors.

Equity is therefore widely available for acquisitions from foreign investors, but investors are becoming more selective about the quality, retail sub-sector and risk profile of particular assets.

Offshore investors are leading acquisitions

The quantum of offshore capital seeking retail opportunities in Australia is higher than it has ever been. Australia still looks very attractive to offshore institutional investors because it is considered to be a low-risk destination.

The depreciation of the Australian Dollar from previous years has added to a host of core fundamental factors which make Australia attractive relative to many developed countries. The stability of the economy is one very important factor. The highly transparent real estate investment process is another critically important factor, in terms of accessing information and research for transaction underwriting and due diligence. Transaction scale has also been a key motivator for many offshore investors in recent years, with many opportunities to complete major transactions, either as individual assets or as a portfolio. There has been 32 retail deals above $200 million since the start of 2012. Finally, the depth of experienced and professional institutional managers in Australia is another major consideration for offshore investors, particularly for the passive investors looking for capital partnering opportunities.

Offshore investors accounted for approximately one-third of the acquisitions in 2016, the highest rate since 2007.

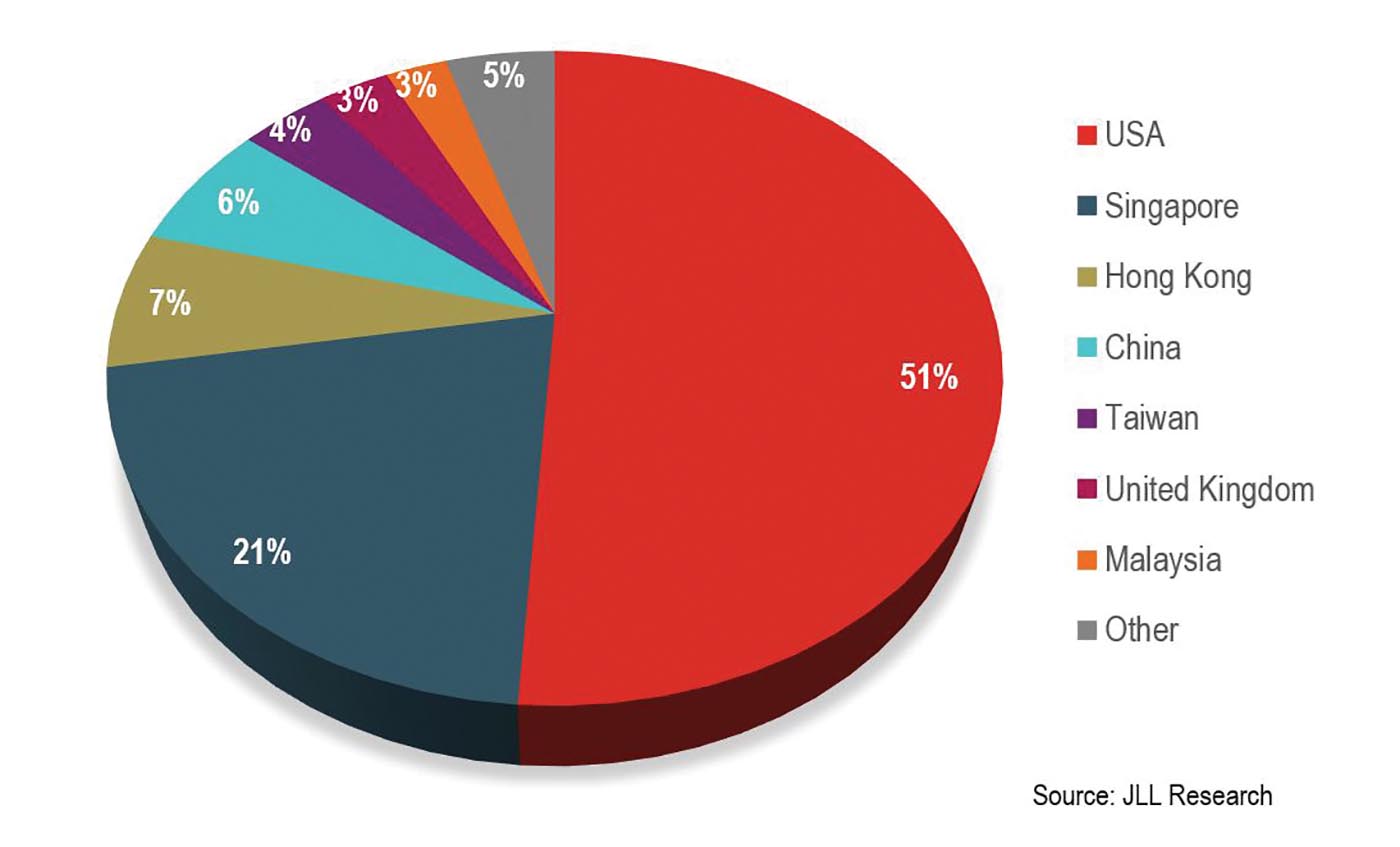

In the last five years, USA accounted for the greatest share (51%) of acquisitions by offshore investors – led by Blackstone, TH Real Estate and J.P. Morgan. Asian investors were also a major contributor (42%).

There is renewed interest in the Australian retail sector from European institutional investors and pension funds, as well as ongoing demand from North American and Asian investors.

Figure 1 – Buyer origin – retail acquisitions by offshore investors, 2011 to 2016

Strategic window for disposals remains open

There is a strategic window of opportunity for owners to offset risk by disposing of assets and capitalising on the record level of demand, in order to rebalance their portfolios, improve portfolio quality and reset for future opportunities. The window of opportunity is not likely to remain open for an extended period of time, given record-low yields, a narrowing of the spread to the real 10-year government bond rate, challenges in the leasing market and any future global political or economic events that may impact sentiment and pricing in the real estate sector.

Bullish or bearish behaviour?

Investors are acutely aware of the downward shift in yields and also the subdued market fundamentals, especially in sub-core assets. The dynamics of the investment market are unusual at present, in the sense that there is record demand for assets, high levels of activity, but investors are still cautious and risk averse in many respects. Leverage is being used conservatively despite the low cost of debt, which is a key difference between this cycle and the last cycle. Yield ranges (between prime and secondary assets) remain wide and above long-term average levels suggesting that investors are pricing secondary assets at a relatively soft yield for this point in the cycle. The buyer pool for secondary-grade assets has been decreasing. Furthermore, many institutional owners are focused on maintaining or improving portfolio quality as a defensive strategy by selling non-core assets as well as upgrading and redeveloping existing assets.

The race to upgrade assets

Owners continue to deploy capital into their extensive development pipelines to primarily upgrade and extend existing shopping centres. Project commencements in 2016 matched the level of completions, suggesting steady level of development activity.

Investors are likely to sell mature, passive assets to fund large development pipelines. Four regional shopping centres began development works in 2016. Many regional centre extensions are highly capital intensive, and ‘on-completion’ values for assets that have recently completed or are currently underway, range between approximately $1.5 to $2.5 billion. Some owners will seek to divest part-shares in large regional shopping centres, either pre or post development, to reduce high exposure to a single asset, and to recycle capital into other development opportunities.

Outlook

The volume of transactions could reach a new record high in 2017, driven by some major individual assets and portfolios. Under current market conditions, high-quality core assets will achieve a significant premium to current book values. Book value cap rates will continue to trail and compress over the next 6-12 months as more transaction evidence emerges. Yields are likely to stabilise beyond 2017 given the potential for upward movement in bond rates and official cash rates, globally.

Australian retail yields and market fundamentals are attractive in a global context, which will continue to support offshore demand. Offshore investors will lead acquisitions of major assets again this year, but domestic institutions will continue to selectively invest. There will be a continuation of the trend where domestic owners seek offshore capital partners for major assets and continue to dispose of smaller assets, in order to fund developments to bolster their portfolios, reduce risk and maintain low gearing.